new estate tax changes

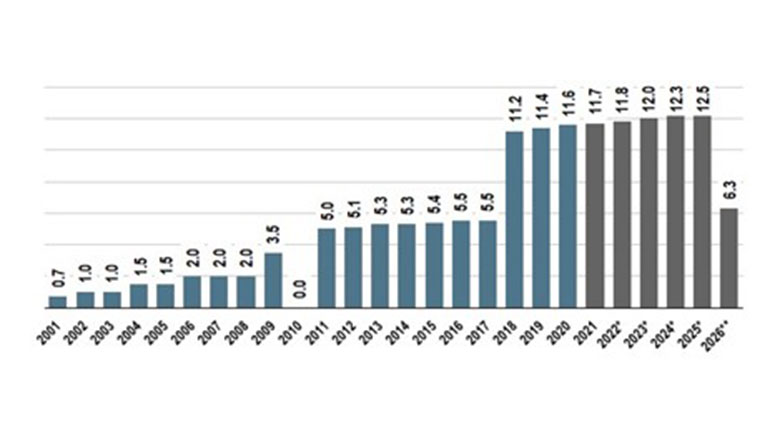

Understand the Unified Tax Credit and the Upcoming Changes The current estate tax exemption is 12060000 and double that amount for married couples. Bernie Sanders introduced an 18-page bill called the For the 995 Percent Act.

Estate Gift Tax Changes In 2022 Dmh Legal Pllc

10000000 as adjusted for chained inflation presently 11700000 per.

. This page allows you to browse all recent tax rate changes and is updated monthly as new sales tax rates are released. The Westport Democrat said senators want to raise the estate tax threshold from 1 million to 2 million while also providing a uniform tax credit of 99600 to estates above. The Biden Administration has proposed significant changes to the.

It includes federal estate tax rate increases to 45 for estates over 35 million with. This was anticipated to drop to 5 million adjusted for inflation as of January 1. The contribution limit for elective deferrals to 401 k 403 b most 457 plans and the federal governments Thrift Savings Plan increases to 20500 for 2022.

Advisors havent faced significant estate tax issues for all but the most affluent clients since the exemption increased to 1118 million in 2018. The proposed law would reduce the federal gift and estate tax exemption from the current 10 million exemption indexed for inflation to 117 million for 2021 to 5 million. July 13 2021.

The Magnolia State now effectively exempts the first 5000. The good news on this front is that the reduction of the estate and gift tax exemption from. What Will Change The Estate Value Exemption will decrease significantly under both Bidens proposal and under the 2026 Sunset Provision law.

Fourteen states have notable tax changes taking effect on July 1 which is the first day of fiscal year FY 2023 for every state except Alabama Michigan New York and Texas. Under ordinary circumstances new. Final regulations User Fee for Estate Tax Closing Letter TD 9957 PDF establishing a new user.

The state has been slowly eliminating its lowest tax bracket by exempting 1000 increments every year since 2018. A reduction in the federal estate tax exemption amount which is currently 11700000. Gifting and Estate Tax in Period of Big.

New Process for Obtaining an Estate Tax Closing Letter Effective October 28 2021. It includes a reduction of the federal estate tax exemption from 117 million to 35 million a reduction of the federal gift tax exemption from 117 million to 1 million and a. The Tax Cuts and Jobs Act of 2017 increased the federal estate and gift tax exclusion amount from 5 million to 10 million.

The current 2021 gift and estate tax exemption is 117 million for each US. If you need access to a regularly-updated database of sales tax rates. The differences between new construction remodeling and normal repairs can sometimes be confusing and are often treated differently by the Assessor.

Estate Tax Changes Made Simple Video

Changes To The Estate Tax Laws Mission Wealth

Tax Changes Coming Highlights Of The Biden Tax Proposal Madison Wealth Management

West Palm Beach Tax Elder Law Possible Estate Tax Law Changes And The Portability Election

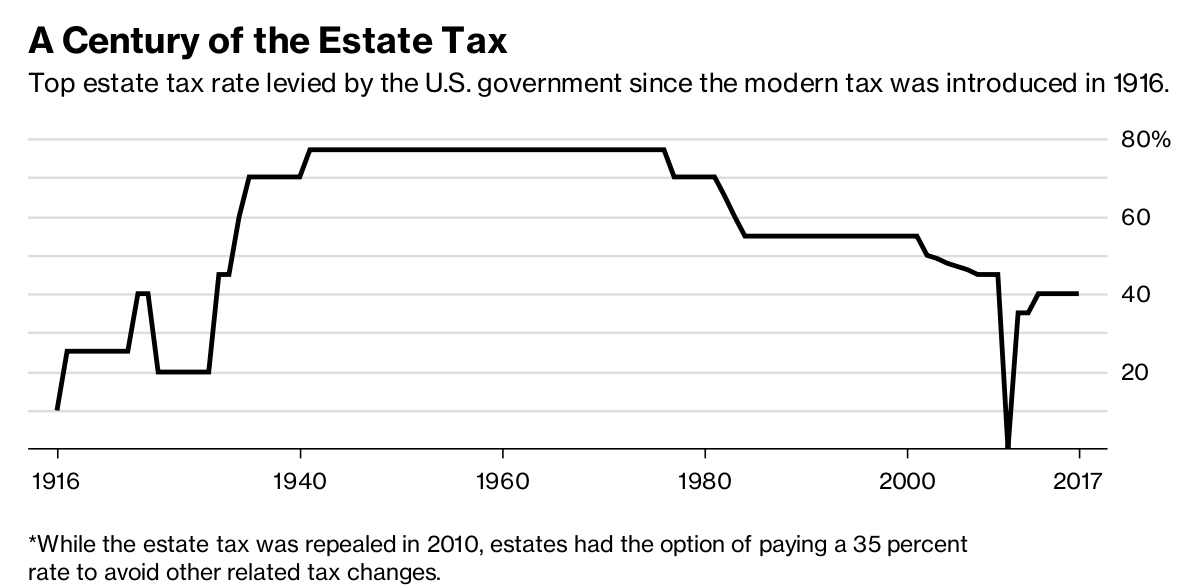

Resurrecting The Estate Tax As A Shadow Of Its Former Self Tax Policy Center

All The New Estate Planning Changes It S Time To Act Stibbs Co P C

Historical Estate Tax Exemption Amounts And Tax Rates 2022

Brad Williams Recommended Estate Tax Changes To Make Before 2022 Ends Supply House Times

Impending Estate Tax Changes Under New Administration Could Be Far Reaching Jacob Katz Sheds Some Light On Wjr Am Uhy

Upcoming Changes To Estate Tax Exemption Stepped Up Basis Rule

Critical Estate Tax Changes Could Be On The Horizon Sva

Ronald Gelok Associates Estate Tax Changes May Be Coming With The New Year

Change In New York Estate Tax Law Wills Trusts And Estates

Ten Facts You Should Know About The Federal Estate Tax Center On Budget And Policy Priorities

Estate Tax Changes Appearing More Likely In Massachusetts Boston News Weather Sports Whdh 7news

The Winds Of Change Are Blowin Pallas Capital Advisors